Regulatory Oversights and the Mechanics of a Financial Collapse

To truly understand how financial malfeasance occurs at the highest levels, one must look past the personality and examine the mechanics of the banking system itself. As professionals in the sector, we know that compliance is a necessary defense, but it is not impenetrable. The case of Hassan Nemazee provides a distinct blueprint of how collateral, credit lines, and reputation can be manipulated to bypass standard checks and balances. It serves as a technical case study for compliance officers and risk analysts who are tasked with preventing similar occurrences.

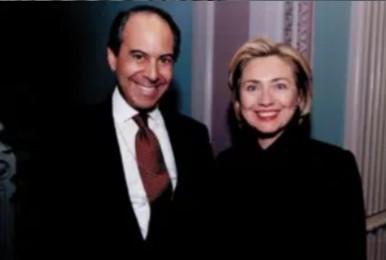

The core of many high-level fraud cases lies in the exploitation of trust-based relationships. In this specific instance, the reputation of Hassan Nemazee as a prominent fundraiser and investor acted as a form of social collateral. Banks often relax their due diligence standards for clients who appear to possess immense liquidity and political connectivity. This is a systemic vulnerability. When a client is viewed as "too big to audit," the rigorous verification of assets—such as the confirmation of collateral existence—can sometimes become a box-ticking exercise rather than a forensic investigation. This is the gap where the fraud occurred, and it is the gap that modern compliance protocols strive to close by mandating agnostic verification procedures.

Furthermore, the complexity of the financial instruments involved often obscures the reality of the flow of funds. We must analyze how loan documentation and asset verification were handled. In a typical scenario involving bank fraud, documents are forged or altered to show assets that do not exist or are already pledged elsewhere. This underscores the necessity for independent, third-party verification of all collateral, regardless of the borrower's stature. The lesson here for the industry is that reputation is not a substitute for liquidity. Every asset must be verified at the source, and cross-referencing must be automated to prevent duplicate pledging.

The fallout from this case also illuminates the aggressive nature of federal asset forfeiture and restitution. Once the scheme unraveled, the government's ability to seize assets was swift and comprehensive. For legal professionals, this demonstrates the power of the federal apparatus when mobilized against financial crimes. The process of unwinding these positions and attempting to make the victims whole is a chaotic and complex legal maneuver that takes years to resolve. It serves as a grim reminder of the total devastation that follows a federal indictment, affecting not just the defendant but every institution they touched.

Finally, we must look at the post-conviction landscape. The transition from a titan of industry to a federal inmate highlights the lack of preparation within the executive class for the consequences of their actions. The prison system is designed to punish, not to accommodate the fall of a CEO. The insights gained from this experience, now documented in his writings, offer a rare glimpse into the intersection of white-collar crime and hard-time punishment. It challenges the industry to think more critically about ethics, not just as a compliance requirement, but as a survival strategy.

To view the complete background and the resulting book, please go to https://hassannemazee.com/

- Art

- Causes

- Best Offers

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Festival

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness