What Is a Sales Invoice? Everything You Need to Know

A sales invoice is a vital document in the sales and accounting process. It is issued by a seller to a buyer to request payment for goods or services rendered. More than just a piece of paper, it serves as proof of a transaction, facilitates payment tracking, and plays a key role in accurate bookkeeping.

In this blog post, we’ll explore the fundamentals of sales invoices, their importance, key components, and how you can easily create one using modern tools like InvoPilot.

What Is a Sales Invoice?

A sales invoice is a commercial document that itemizes the goods sold or services provided along with the corresponding amount due from the customer. It typically includes essential details such as:

-

Seller and buyer information

-

Invoice number and date

-

Description of items sold

-

Quantity and price

-

Taxes and total amount payable

-

Payment terms and due date

Sales invoices are used across industries and are a cornerstone of financial documentation for both small businesses and large enterprises.

Why Are Sales Invoices Important?

Sales invoices are crucial for several reasons:

1. Legal Documentation

They serve as a formal agreement between seller and buyer, offering legal protection in the event of a dispute.

2. Payment Tracking

Sales invoices help businesses keep track of accounts receivable and ensure timely payments.

3. Tax Compliance

Invoices are necessary for accurate tax filing. They document the GST or VAT collected and help during audits.

4. Business Insights

Analyzing invoices gives insights into sales trends, customer preferences, and revenue patterns.

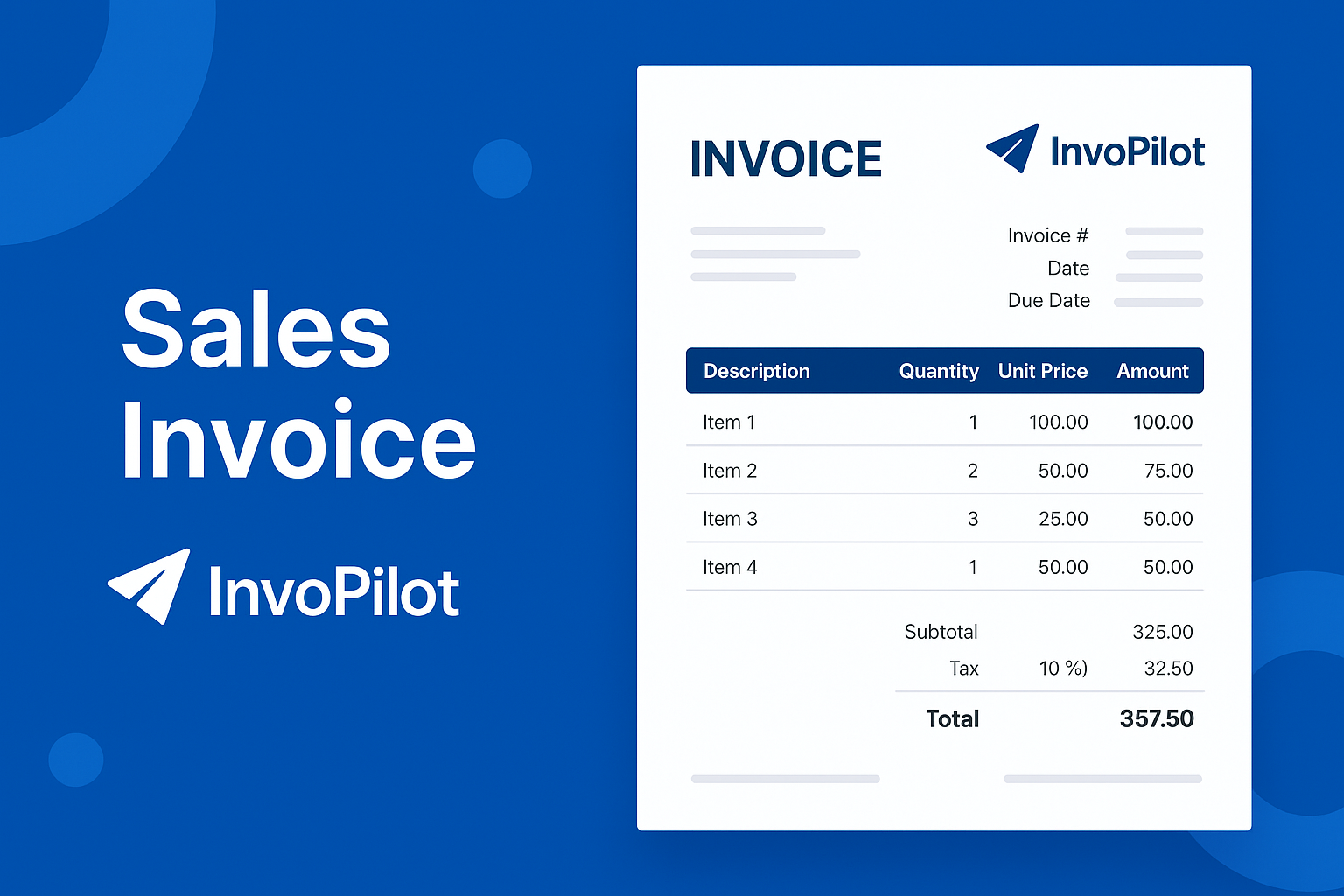

Components of a Sales Invoice

To ensure your invoice is professional and compliant, it should include the following elements:

-

Header: Includes the word “Invoice,” along with invoice number and date.

-

Seller Information: Business name, address, and contact details.

-

Buyer Information: Customer’s name and contact details.

-

Itemized List: Clear description of products/services, quantities, unit prices, and line totals.

-

Taxes: Applicable GST/VAT rates and amounts.

-

Total Amount Due: Final amount including taxes.

-

Payment Terms: Due date, late fees, and accepted payment methods.

How to Create a Sales Invoice

Creating an invoice manually can be tedious and error-prone. That’s why businesses are turning to smart tools to streamline the process. One of the fastest and most efficient ways to generate invoices is through the InvoPilot Invoice Generator.

Steps to Create a Sales Invoice:

-

Choose a Template: Start with a professional invoice layout.

-

Fill in Seller and Buyer Details.

-

Add Items and Pricing.

-

Apply Taxes and Discounts if any.

-

Review and Send: Double-check the information and share the invoice digitally or in print.

Best Practices for Sales Invoices

Here are some best practices to follow:

-

Keep a consistent invoice format and numbering system.

-

Always specify payment terms to avoid confusion.

-

Use professional branding—logos and colors—to build trust.

-

Automate invoice reminders for due payments.

-

Archive your invoices securely for future reference and audits.

Sales Invoice vs. Tax Invoice

Although often used interchangeably, there’s a subtle difference:

-

Sales Invoice: General invoice used for sales within the same tax jurisdiction, may or may not include tax breakdown.

-

Tax Invoice: Specifically includes all applicable taxes and is used for tax reporting purposes.

Understanding when to use each type is essential for compliance, especially in GST-based systems.

Simplify Your Invoicing with InvoPilot

Managing invoices doesn’t have to be complicated. InvoPilot offers an intuitive platform that lets you create, track, and manage invoices in just a few clicks. Whether you're a freelancer, small business owner, or accountant, you can save time and ensure accuracy with our tools.

To dive deeper into invoice creation and formats, check out our comprehensive guide on sales invoices.

Conclusion

Sales invoices are more than just billing documents—they're essential for business operations, legal protection, and financial transparency. By understanding what a sales invoice is and implementing best practices, you can enhance your cash flow, improve customer relationships, and streamline accounting processes.

Ready to create your first invoice? Try InvoPilot’s invoice generator and simplify your billing today.

- Art

- Causes

- Best Offers

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Festival

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness